Corporate Presentation

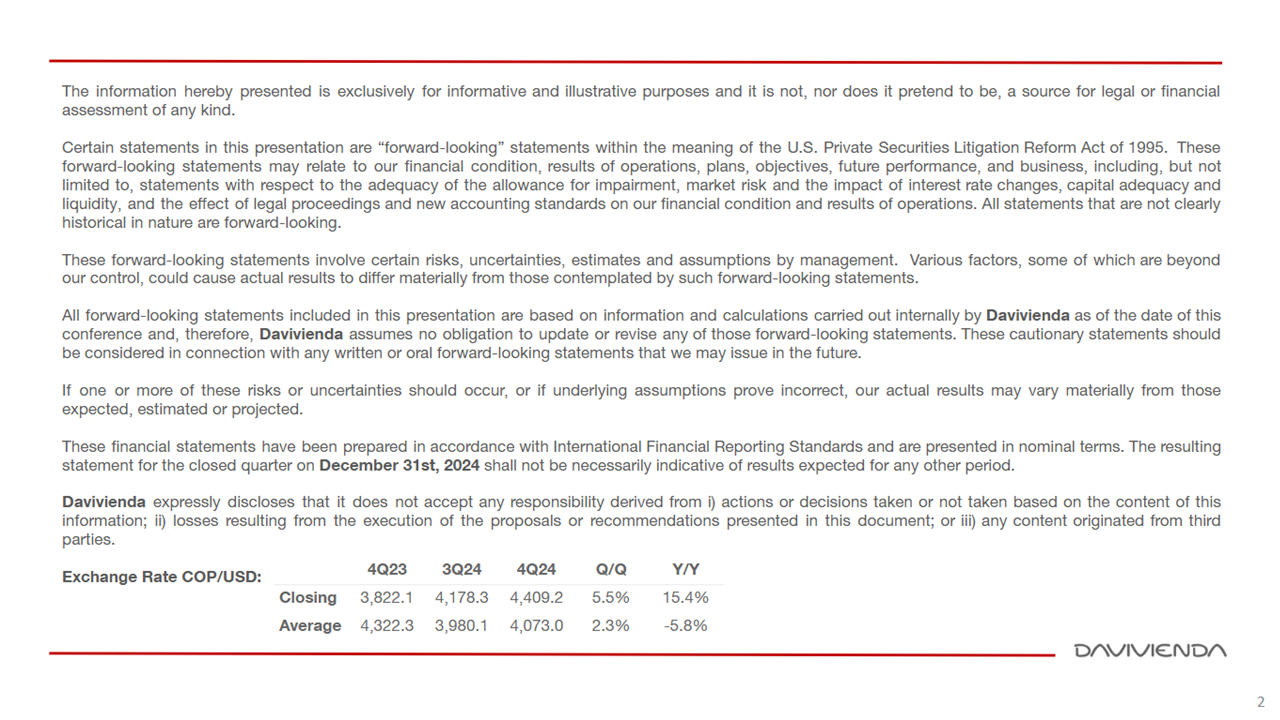

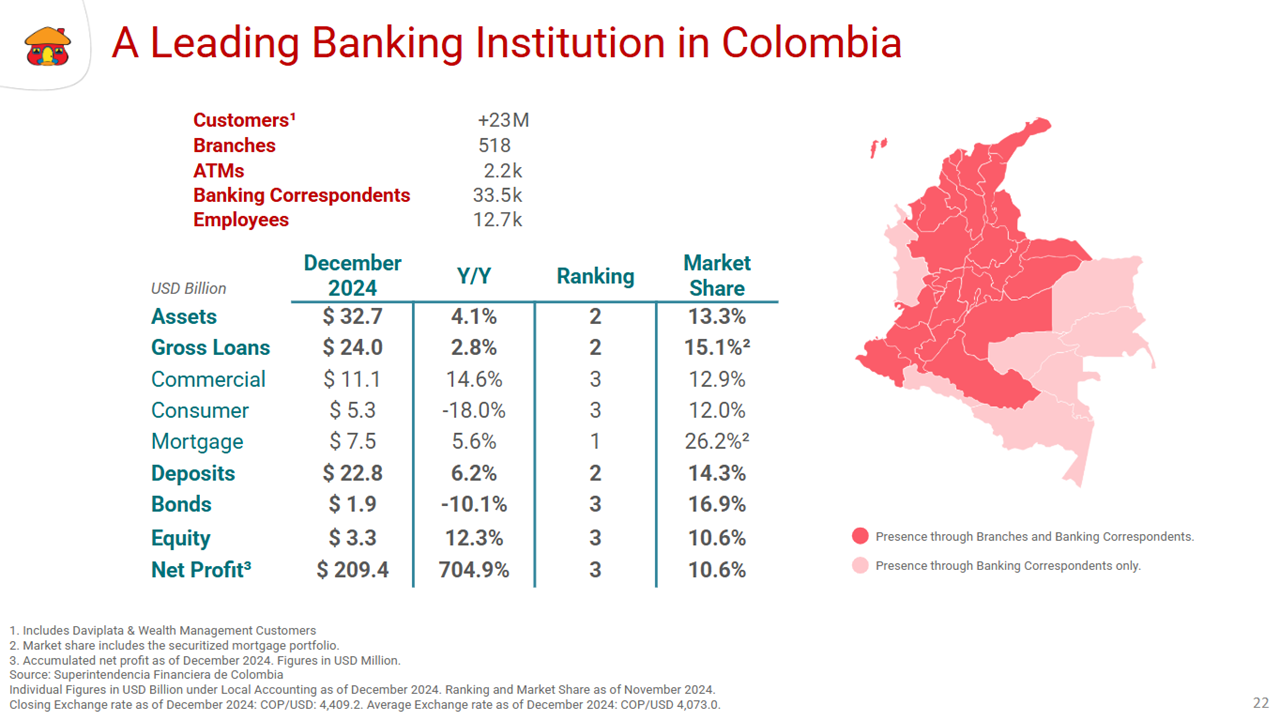

Davivienda is a regional bank leader that operates in six countries (Colombia, Panama, Costa Rica, El Salvador, Honduras, and the United States). With over 52 years of experience in the Colombian market, Davivienda offers a wide range of financial services to individuals, SMEs, and corporate customers. The bank currently serves over 24.9 million customers through a network of 658 branches and more than 2,811 ATMs.

About Davivienda

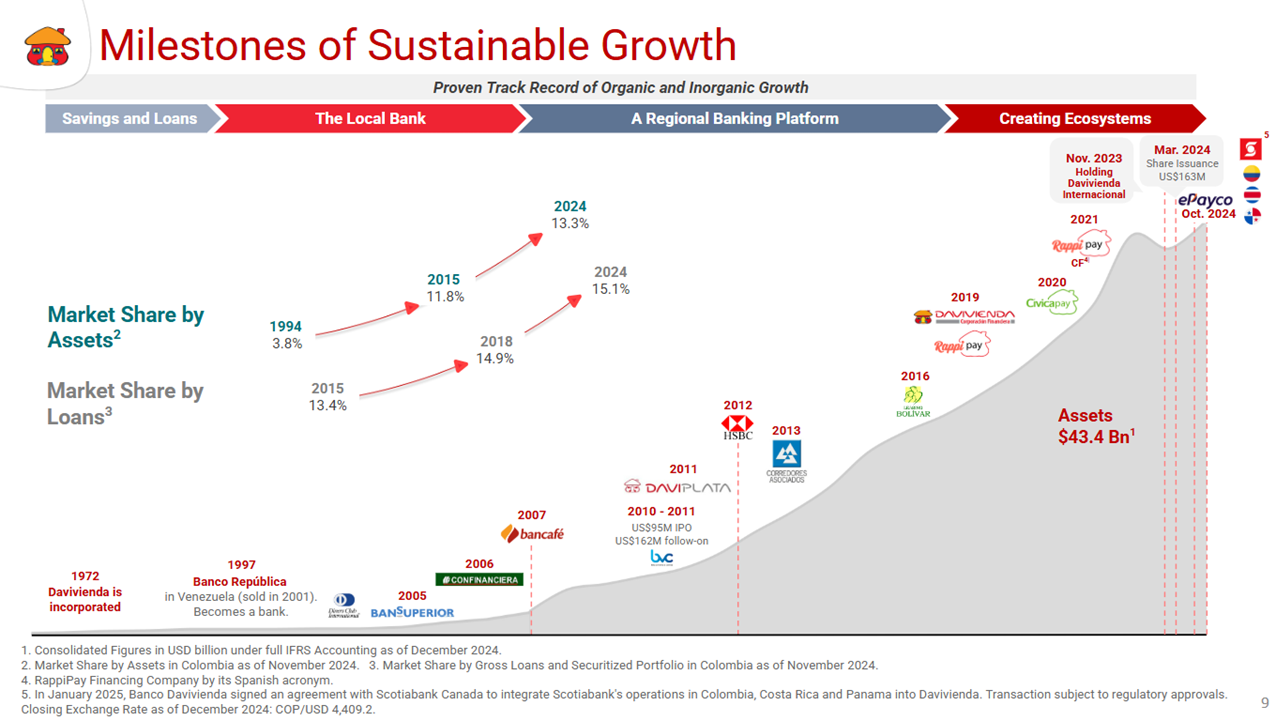

Davivienda has been in business for over 50 years. Formerly incorporated as Corporación de Ahorro y Vivienda in 1972 in Colombia, Davivienda is going through a steady and strong expansion process since 2005.

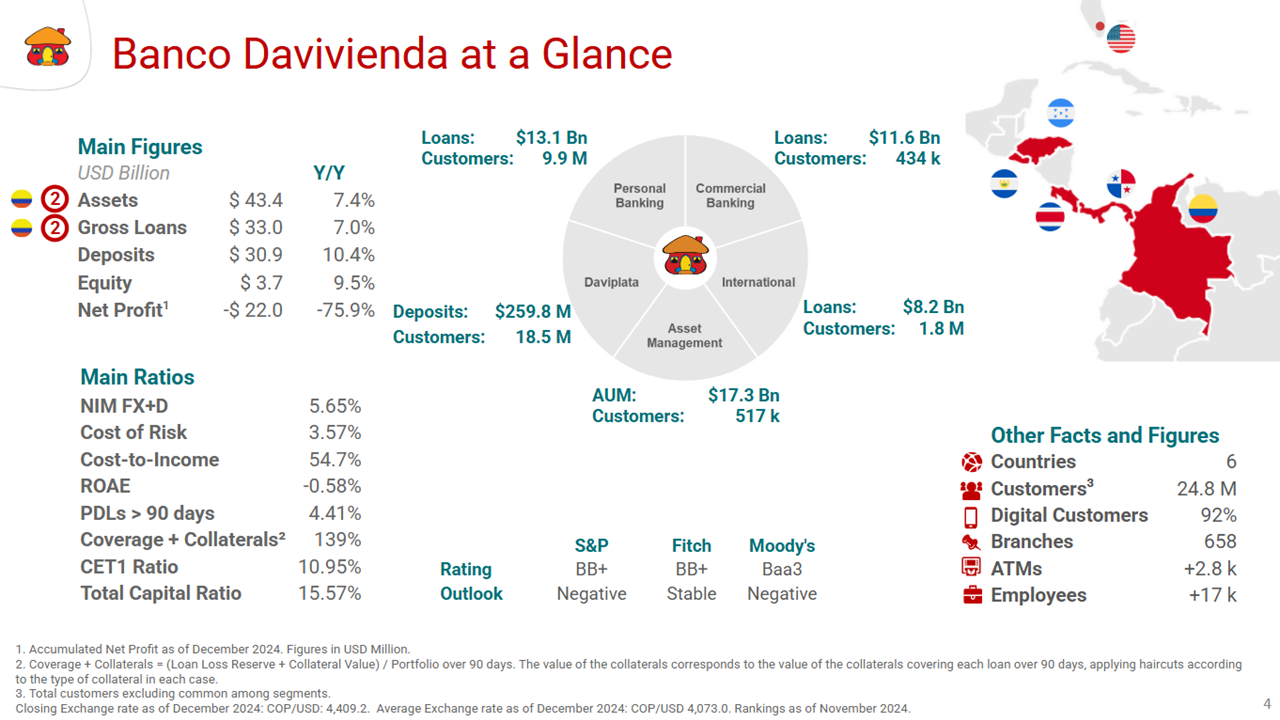

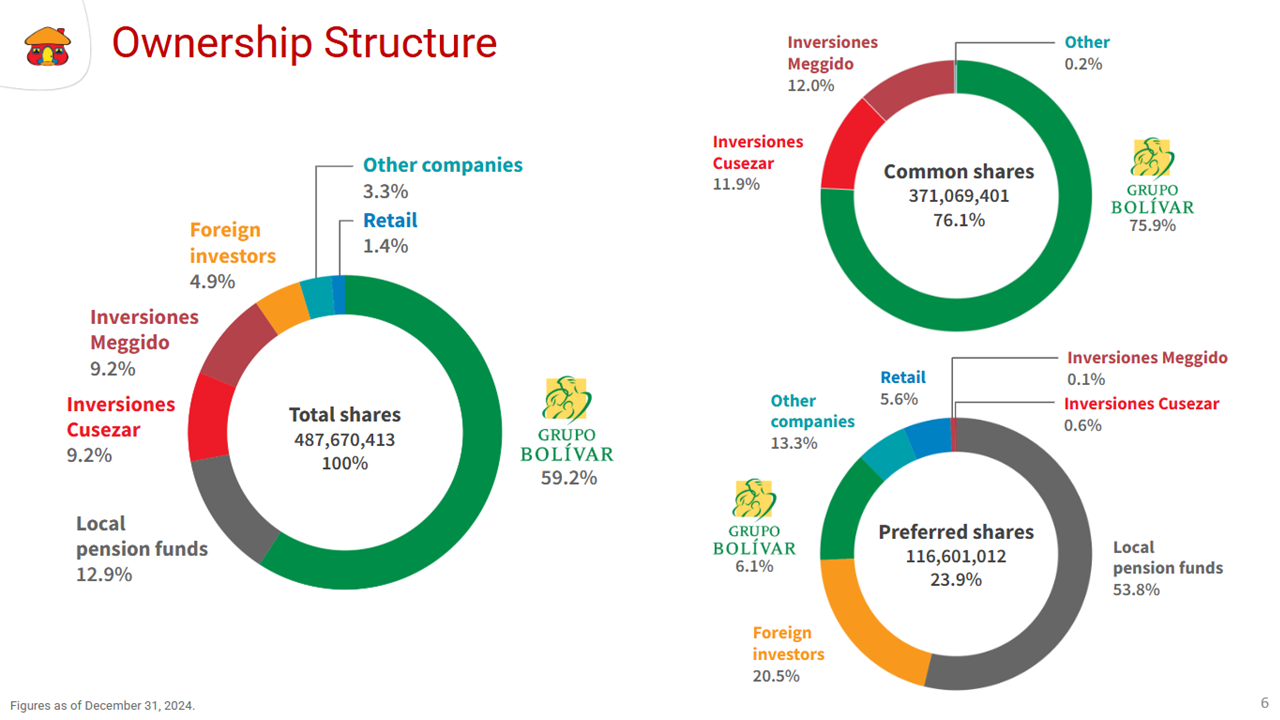

Banco Davivienda is owned by Grupo Empresarial Bolívar. A regional holding with more than 80 years of experience in the insurance, banking, and building industries. Learn more about the group

History: Corporate Information

Davivienda has over 50 years of experience creating value-added to people and companies throughout Colombia and Central America.

1972

We seek to deliver simple, reliable, and friendly experiences to our customers. In order to achieve this goal, we rely on a team that develops a value offer based on innovation, risk management, efficiency, and synergy between business lines.

1973

Coldeahorro was renamed Corporación Colombiana de Ahorro y Vivienda Davivienda.

1994

Davivienda became a credit card issuer.

1997

Davivienda turned into a commercial bank under the name of Banco Davivienda S.A. and focused on its consolidation in the Colombian financial sector.

Davivienda acquired Banco República de Venezuela (sold in 2001).

2006

Davivienda merged with Banco Superior.

2007

Davivienda acquired Granbanco S.A./Bancafé and increased its commercial portfolio services along with its international presence expanding to Panama and Miami.

2010

Davivienda announced its IPO in the Colombian Stock Exchange.

2011

Davivienda announced a follow-on offering on the Colombian Stock Exchange.

Davivienda launched DaviPlata, a free service that enables Colombians to make financial transactions with their mobile phones.

2012

Davivienda acquired HSBC operations in Costa Rica, Honduras, and El Salvador, which strengthened its regional presence in the Americas.

2013

The bank acquired Corredores Asociados, strengthening its business offer in wealth management.

2016

The Bank merged with Leasing Bolívar S.A. and increased its value offer to SME customers.

2019

The RappiPay Davivienda partnership begins in Colombia. This alliance boosts digital and secure payments, lowering access and transaction costs.

2023

Holding Davivienda Internacional S.A., based in Panama is created, bringing together the Central American subsidiaries of Banco Davivienda

2024

Davivienda returns to the stock market with a successful issuance of common and preferred shares for COP $720 billion, consisting of 27,392,472 common shares and 8,607,528 preferred shares, for a total of 36 million shares issued.

Davivienda acquires ePayco to strengthen its digital payment solutions and provide a more complete and value-added offer to its customers.

Learn more

about our management model

We strive to deliver straightforward, reliable, and user-friendly customer experiences, relying on a team that builds a value proposition founded on innovation, risk management, efficiency, and synergy between companies.

Strategy Davivienda

Our Purpose

Enriching Life with Integrity

Here at Davivienda, we strive to achieve the superior purpose we share with all Grupo Bolívar’s companies, through the essence of our organizational culture and our management model.

Organizational Culture

A culture that ties all Grupo Bolivar companies together

Our culture has enabled us to support people’s wellbeing, help families build their equity, grow businesses and fund projects to benefit the countries where we operate.

Our Mission

We add value for our clients, community and investors through a team of upstanding, committed, and friendly individuals who are always willing to learn and work with integrity

Principles and Values

Davivienda shares and promotes the principles and values established by Grupo Bolívar. We take pride in highlighting the core values that support our organizational culture:

- Respect

- Equity

- Honesty

- Discipline

- Enthusiasm, Joy and Cheerfulness

Corporate Strategic Objectives

For Davivienda, the strategic objectives are the objectives that the Bank intends to achieve with which it will generate greater value for its stakeholders. For this reason we have defined the following objectives:

Customer Service Leaders

We are committed to provide the best customer service; our management model revolves around our customers, and we strive to reach them through straightforward, reliable and user-friendly experiences.

Effectiveness and Efficiency

We accomplish our goals, innovate and optimize processes to achieve the best use of resources under a cost-optimization approach.

Risk Management

We all manage risk, foresee new opportunities and seize them, enabling business growth and sustainability.

Talent Management

We assemble the best team of professionals and strengthen their skills to attain what we set out to achieve.

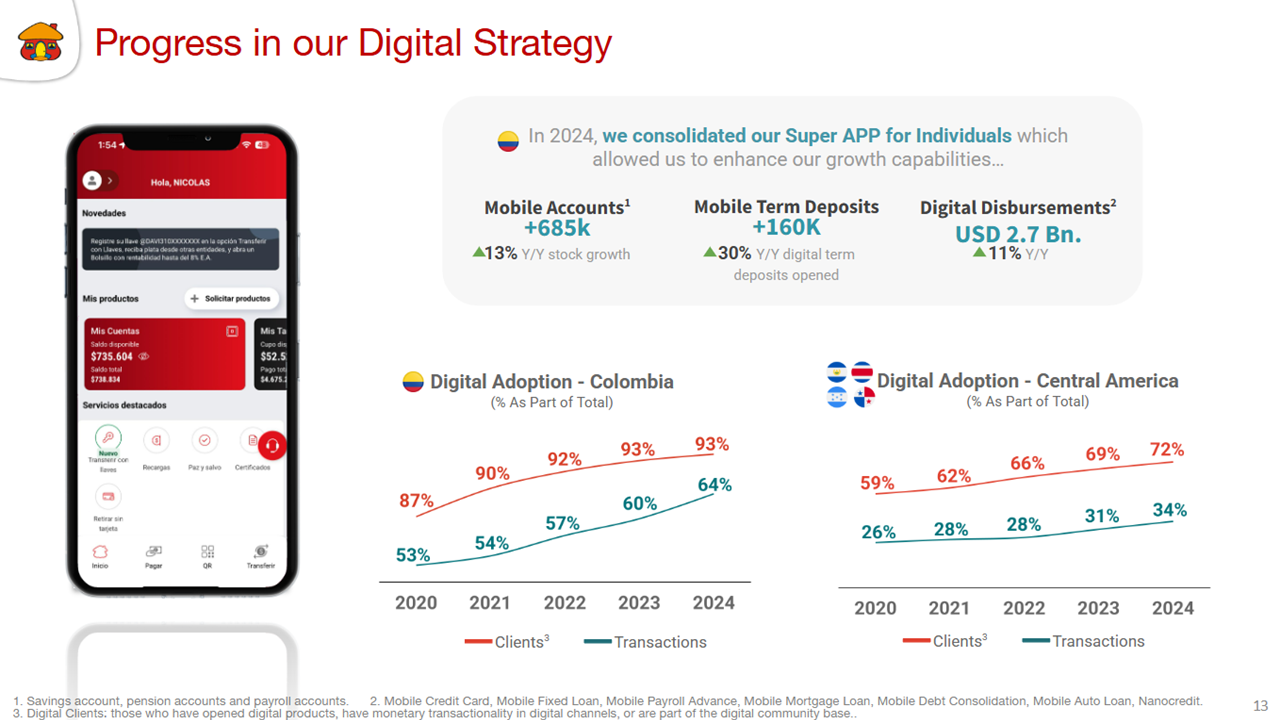

Digital Management:

We are a digital organization at the core. We are innovative, agile and flexible to simplify life for our clients.

Regional Management

We act as one bank, identifying best practices and adapting to suit each market in the countries where we operate.

Sustainable Management

We positively impact society and the environment beyond our operations in the countries where we operate.

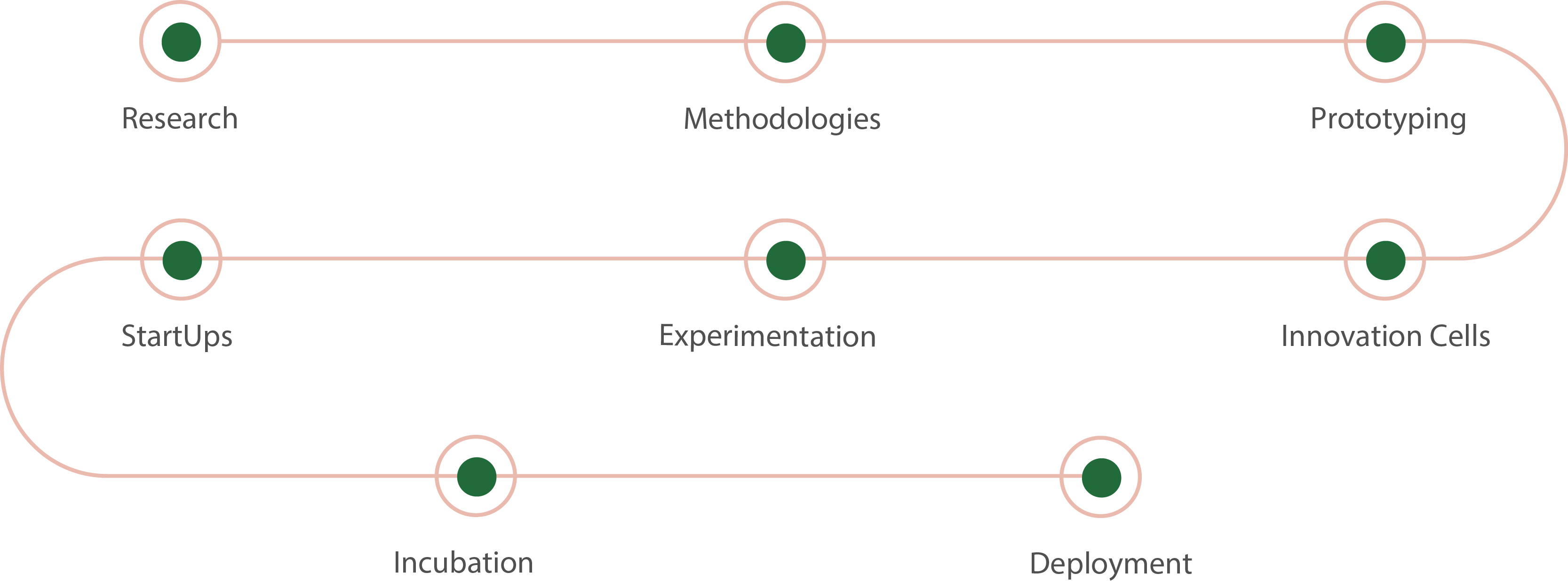

Innovation Model – Grupo Bolívar

At Grupo Bolívar, we have consolidated an Innovation Model based on innovation as a cornerstone within our organization to design simple, reliable, and friendly experiences for our customers.

We have developed an Innovation Culture based on strengthening our staff’s capabilities and skills within Innovation Ecosystems (Startups, Universities, Companies from other industries, Government and World-class Partners).

In 2018 we officially opened Domo I, Grupo Bolivar’s innovation center seeking to develop:

- New experiences for our customers

- Digital transformation projects through our Innovation Model

- Partnerships with crucial drivers among innovation and entrepreneurship ecosystems: academia, government, and businesses.

Learn more about Grupo Bolivar innovation

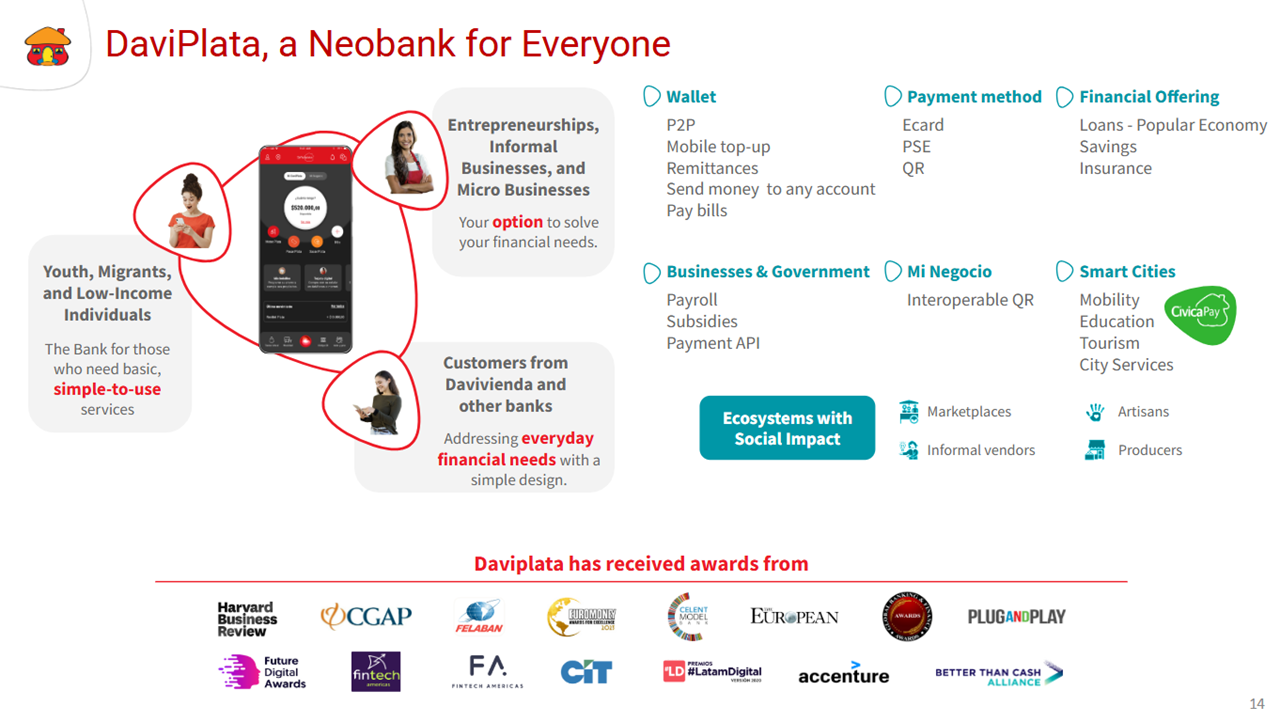

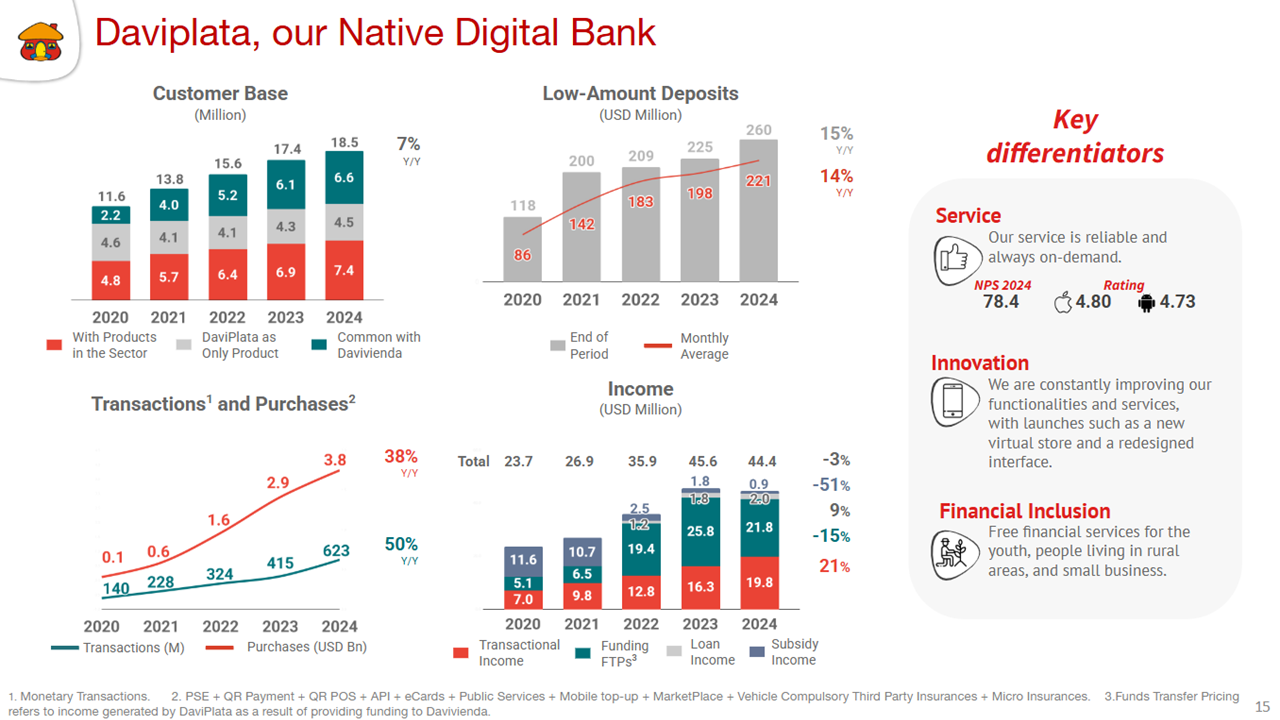

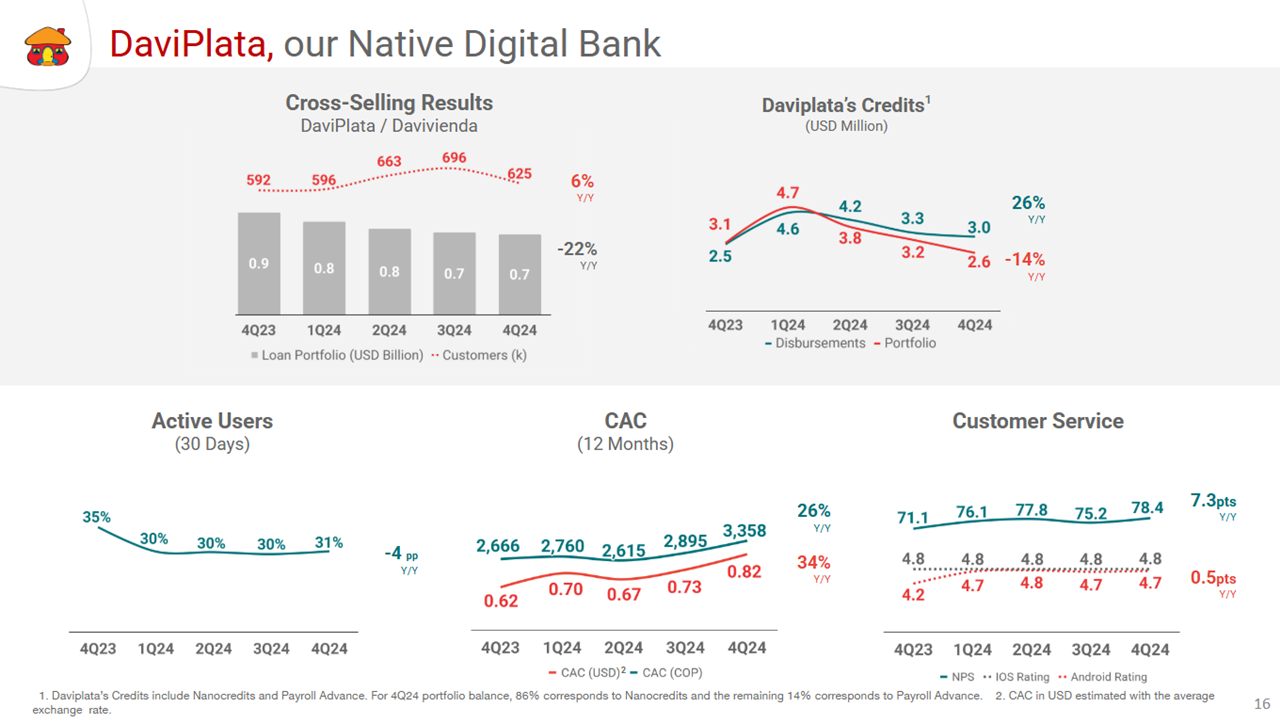

DaviPlata

DaviPlata was launched in February 2011 as a cash management service in Colombia.

DaviPlata is the digital solution that democratized access to financial services by leveraging the potential of mobile phones. DaviPlata was the first platform that enabled anyone in Colombia to:

- Transfer money via social media.

- Make free interbank transfers.

- Have a prepaid e-card instantly.

- Receive subsidies through a mobile solution.

- Manage one’s money over a cellphone without any data charges.

- Withdraw or deposit cash on ATMs without a card.

- Use its full interface even when the user has a disability.

Today, DaviPlata is more than a convenient payment system. Our wallet is linked to partner companies enhancing their value-added strategies for everyone who interacts with them.

DaviPlata has expanded beyond Colombian borders and is now also in El Salvador, where it has grown hand-in-hand with the Financial Inclusion Law, fostering the use of electronic deposits and simplified accounts in the country.

The Casita Roja feature made Davivienda win the international Model Bank award in 2018 in the Consumer Channel Innovation category. While our customers are on their social media, they can transfer money, split checks, or add credit to prepaid cell phone plans.

DaviPlata, Our Digital Native Bank

Our Team

- Carlos Arango was born in 1951.

- Economist from the University of Antioquia, with a postgraduate degree in the Senior Business Management Program at INALDE Business School .

- Since 1983, President of Constructora Bolívar SA, he has served as Director of a first-level Agency at Conavi , Financial Assistant at Compañía Seguros Bolívar in Medellín and Manager of the Construction Department at the same entity.

- During his long work experience, he has had the opportunity to be a member of different Boards of Directors in the financial sector, such as Capitalizadora Bolívar SA, Seguros Comerciales Bolívar SA Fiduciaria Davivienda SA, which has given him extensive knowledge in comprehensive risk management, and in the understanding, monitoring and strengthening of Internal Control Systems.

- He is not subject to any cause of inability or incompatibility according to the law and the Good Governance Code of Banco Davivienda.

- Álvaro Carrillo born in 1968.

- Economist and Specialist in Project Preparation and Evaluation from the Universidad del Rosario. He also completed a diploma in Strategic Management at the Universidad del Rosario and a diploma in Advanced Banking Management at the Universidad de los Andes.

- At Banco Davivienda he has served as Professional, Assistant, Head and Director of the Planning Department, Assistant to the President, Administrative Vice President, Executive Vice President of Personal Banking and Executive Vice President of Corporate Banking. Since 2021, he has held the position of President of Seguros Bolívar SA In addition; he has more than 10 years of experience in Financial Risk and Credit Risk issues in banking entities.

- He has extensive experience on Boards of Directors, such as Seguros Bolívar, Titularizadora , Fiduciaria Davivienda, Corredores Davivienda. Currently, he is a Principal Member of the Board of Directors of Capitalizadora Bolívar, Titularizadora y Seguros Comerciales Bolívar.

- He is not subject to any cause of inability or incompatibility according to the law and the Good Governance Code of Banco Davivienda.

- Álvaro Peláez was born in 1951.

- Civil Engineer from the University of the Andes. During his professional experience he has focused on the financial and housing construction sectors, specifically in the company Cusezar SA, where he worked as a programming and budgeting engineer, construction resident in Bogotá and up to the position of General Manager.

- He has served as Alternate Member of the Board of Directors of Banco Superior, Granbanco , Constructora Solidez in liquidation, Constructora Portobelo , Constructora Monticelo SA and serves as a principal member of Banco Davivienda.

- He is not subject to any cause of inability or incompatibility according to the law and the Good Governance Code of Banco Davivienda.

- Andrés Flórez was born in 1972.

- Lawyer from Javeriana University with specialization in Insurance Law from the same University and Master of Laws , with emphasis in corporate law, financial legislation and capital markets, from Cornell University .

- He has served as Legal Director of the Bogotá Stock Exchange SA, Assistant Vice President of the Legal Area of Citibank, Deputy Superintendent for Issuers of the Securities Superintendency, Director of FOGAFIN, Principal Member of the Protection Board of Directors and Principal Member of the Board of Directors of the Self-regulator of the Stock Market.

- In addition, he has more than 10 years of experience in Legal Risk, Reputational Risk, and Financial Risk. He also attended ate the ACFE Annual Congress in Nashville, the ACFE Annual Congress in Seattle and several Asobancaria congresses.

- He is not subject to any cause of inability or incompatibility according to the law and the Good Governance Code of Banco Davivienda.

- Diego Molano was born in 1967.

- Electronic engineer from the Pontificia Universidad Javeriana with a Master’s degree in Economics from the Pontificia Universidad Javeriana and an MBA from the International Institute for Management Development – IMD Lausanne , Switzerland .

- He has served as minister of information and communication MINTIC in Colombia. Leader with more than 25 years of experience in cybersecurity issues , in international issues in information and communication, technologies (ICT), innovation, strategy, sales, government, regulation and administration.

- He is currently a main member of the Board of Directors of Banco Davivienda and Compañía de Seguros Bolívar SA

- In addition, he has more than 10 years of experience in Reputational Risk and Technological Risk issues, and attended Telefónica’s Global Reputation Strategy event in Spain.

- He is not subject to any cause of inability or incompatibility according to the law and the Good Governance Code of Banco Davivienda.

- María Claudia was born in 1974.

- Professional in Finance and International Relations from the Externado University of Colombia with a Master’s Degree in Agricultural Economics and Specialization in Marketing and Administration from Cornell University .

- At Proexport she held the position of Market Intelligence and Commercial Manager of Manufacturing and Tourism. She held the position of President of ProColombia between August 2010 and May 2016. Former Minister of Commerce, Industry and Tourism during the period May 2016 to August 2017. She has more than 10 years of experience in issues of reputational, legal, technological and country risk.

- She currently holds the position of Executive Director of AmCham Colombia.

- She has extensive experience on Boards of Directors: BANCOLDEX, Fondo Nacional de Garantías SA, Fondo de Garantías de Entidades Cooperatives FOGACOOP, Fiduciaria Colombiana de Comercio Exterior SA FIDUCOLDEX.

- She is not subject to any cause of inability or incompatibility according to the law and the Good Governance Code of Banco Davivienda.

- On June 26, 2024, she resigned from his position, which will be reported to the General Assembly of Shareholders of the Bank.

- Civil Engineer from the Universidad de Los Andes, with a Master’s Degree in Actuarial Science and another in Finance from Georgia State University. With 30 years at Grupo Bolívar, he has solidified his leadership, promoting the organization’s culture, values, and purpose.

- He began his career at Seguros Bolívar, where he led the creation of Grupo Bolívar’s Risk team and achieved milestones such as the purchase of Bancafé, the acquisition of Bansuperior, and the integration of HSBC in Central America, establishing Davivienda as a multinational bank.

- In 2015, he became President of Seguros Bolívar, and since 2022, he has served as President of Banco Davivienda, widely recognized as the “Casita Roja.” This role has enabled Davivienda to expand into Latin American markets with an innovative and competitive value proposition and a global vision.

- Systems Engineer from Universidad Piloto de Colombia and specialist in Finance from Universidad de los Andes.

- Mr. León served as Secretary of Development, Technical Delegate, and Technical Director at the SFC, Operations and Systems Vice President and SARC Director at Banco Cafetero and Vice President of Operations and Systems at Granbanco S.A. He was a member of the Board of Directors at Securities Market Supervision Commission, Fiducafé S.A.

- Ricardo León was born in 1966.

- Industrial Engineer from Universidad Javeriana with a Master’s degree in Finance and Banking from Universidad de los Andes, with more than 30 years of experience within Grupo Bolivar.

- She joined Davivienda in 1994, and since then she has been the leader of important strategic programs such as the construction and brand management of the Bank and the creation and positioning of DaviPlata.

- Mariza Pérez was born in 1963.

- Mr. Uribe is an Industrial Engineer from Universidad de los Andes with a Specialization in Finance. He completed the Advanced Medex program at INALDE.

- He performed as Executive Advisor at Seguros Bolívar. Mr. Uribe has also served as Management and Credit Card Professional, Credit Card Information System Coordinator, Risk System Coordinator, Planning Projects Coordinator, Planning and Risk Director, and Payment Methods Director at Davivienda. He was an alternate member of BETA’s Board of Directors, Fiduciaria Davivienda.

- Pedro Uribe was born in 1973.

- Industrial Engineer from the Universidad Católica de Colombia, with a specialization in Finance at the Universidad del Rosario and a Diploma Program in Banking Management from the Universidad de Los Andes.

- Within the financial sector, he has worked at Banco Davivienda as Coordinator of Management Information Systems; Head of the Corporate Risk Department; Director of Corporate Credit; Director of SME, Official and Special Business Credit; and Vice President of International Credit.

- Reinaldo Romero was born in 1976.

- Mrs. Echeverry is a Psychologist from Universidad de los Andes, MBA from Universidad Pontificia Comillas in Madrid and a professional coach. She worked six years at BBVA leading the Human Resources areas of Corfigan and Seguros BBVA.

- She worked at Microsoft as Human Resources Manager for Colombia, leading the Andean Region Strategy. Between 2007 and 2017, Mrs. Echeverry worked at Ericsson as Chief Human Resources Officer for Latin America and the Caribbean. She joined Davivienda’s team in September 2017 as CHRO to support the Bank’s digital transformation from a talent-oriented perspective.

- Martha Luz Echeverri was born in 1972.

- Accountant and Business Administrator from the University of Pennsylvania. He has over 20 years of experience in the financial sector. He held executive positions at Bank of America, Banco Santander Colombia, Santander Central Hispano (Madrid), BBVA, Davivienda, Citibank Colombia, and Old Mutual Skandia.

- He served on the Boards of Directors at: Fiduciaria Davivienda,Compañía de Seguros Bolívar, Pensiones y Cesantías Santander, Santander Investment Trust, BNP Paribas Corporación Financiera, Gas Natural Colombia ESP, Emtelsa, Fiduciaria de Occidente and Citibank Colombia; and as an alternate member of the Board of Directors of Citibank Colombia and Citivalores S.A., Stock Broker.

- Daniel Cortés was born in 1967.

- Industrial Engineer from Universidad Javeriana, with a specialization in Finance from Universidad EAFIT-CESA INCOLDA, and Senior Management Program from PADE-INALDE.

- Mr. Rojas has over 27 years experience in the financial sector within companies such as Diners Club Colombia, Diamante CFC, Fiduciaria Union and Grupo Colpatria, where he held various positions in the Treasury, Finance and Commercial areas.

- His most recent positions have been as Leasing Bolívar S.A. CEO, Chief Corporate and International Banking at Banco Colpatria Officer, and Chief Commercial Banking Officer at Banco Davivienda.

- He has served as a member of the Board of Mineros S.A., Banco Colpatria, ACH Colombia S.A. and Davivalores S.A.

- Jorge Rojas was born in 1964.

- Mr. Castañeda earned a BA in Business Administration at EAFIT University and a Master of International Business at Western University in Sydney, Australia.

- He was Foreign Exchange Division Manager and Chief Treasury Officer at Banco Industrial Colombiano. He also worked at Banco Cafetero as Chief Treasury Officer and currently serves as Chief Treasury and International Business Officer at Davivienda. He was in Leasing Bancolombia S.A. and Leasing de Colombia Board of Directors.

- Jaime Castañeda was born in 1968.

- Professional in Economic Sciences from the Externado University of Colombia and Master in Financial Economics from the MAF University – Carlos III Madrid, Spain. He has more than 20 years of experience in the financial sector.

- He has served as head and Financial Risk Manager at Grupo Bolívar, Vice President of Personal Banking Credit Executive Director of Personal Banking Credit Risk at Banco Davivienda and Vice President of Bank Insurance and Digital Business at Seguros Bolívar.

- Álvaro Cobo was born in 1975.

.

About our Board of Directors

Learn our Board’s most relevant information please click here.